Tim McGraw + TWG Global

Strategic Partnership Opportunity

The Dodgers Parallel: $2.1B acquisition (2012) to $7.7B valuation (2024)

Long-term hold. Undervalued category. Community asset. Same playbook.

January 2026 | Prepared for Mark Walter & Thomas Tull

Strategic Fit

We Complete TWG's Entertainment Thesis

TWG has built best-in-class sports franchises and Teton Ridge's Western infrastructure. We bring the entertainment programming, live events, and iconic talent to fill that infrastructure.

What TWG Has Built

- Sports Franchises - Dodgers, Lakers, LAFC, Chelsea

- The Cowboy Channel - 100M household reach

- PRCA Rights - 600+ rodeos, exclusive media

- Lonesome Dove IP - Premium Western brand

- Global Venues - Premium F&B opportunities

- Capital & Infrastructure - $10B Mubadala partnership

What We Bring

- Tim McGraw - 30-year icon, sports owner heritage

- Music City Rodeo - Year 1 sellout, 31,750 tickets

- Draft House - Sports bar concept with Titans partnership

- Down Home Media - Content studio (Skydance 15% owner)

- $80M+ Music Catalog - Hard asset floor

- Nashville Market - 2027 stadium, sports expansion

KEY RELATIONSHIP: David Ellison (CEO, Paramount/Skydance) is a 15% partner in Down Home.

He modeled Skydance after Thomas Tull's Legendary Pictures. David is the direct introduction to TWG.

Timing

Why TWG Needs This Now

Five converging forces create a narrow window to build the definitive Western entertainment platform.

Country Surge

+57% streaming growth since 2020

Nashville Boom

20M+ visitors. $2.1B NFL stadium 2027

Rodeo Explosion

Houston: $224M. PBR valued $1B+

PRCA Window

Teton Ridge has exclusive rights

No Competitor

First-mover advantage

The Window: 24-36 months before 2027 Nashville stadium. The infrastructure exists. The talent exists. The capital is the catalyst.

The Anchor Asset

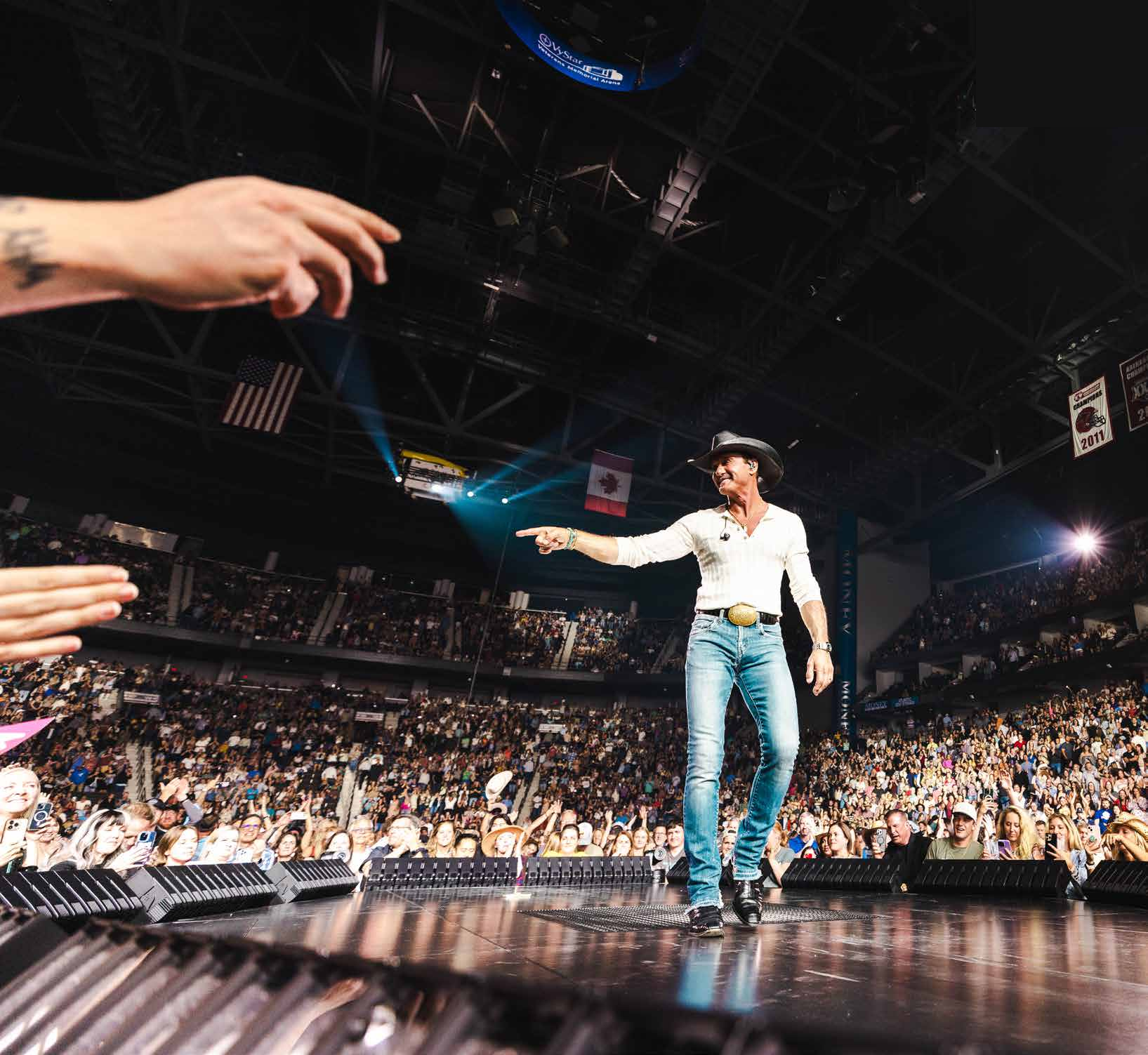

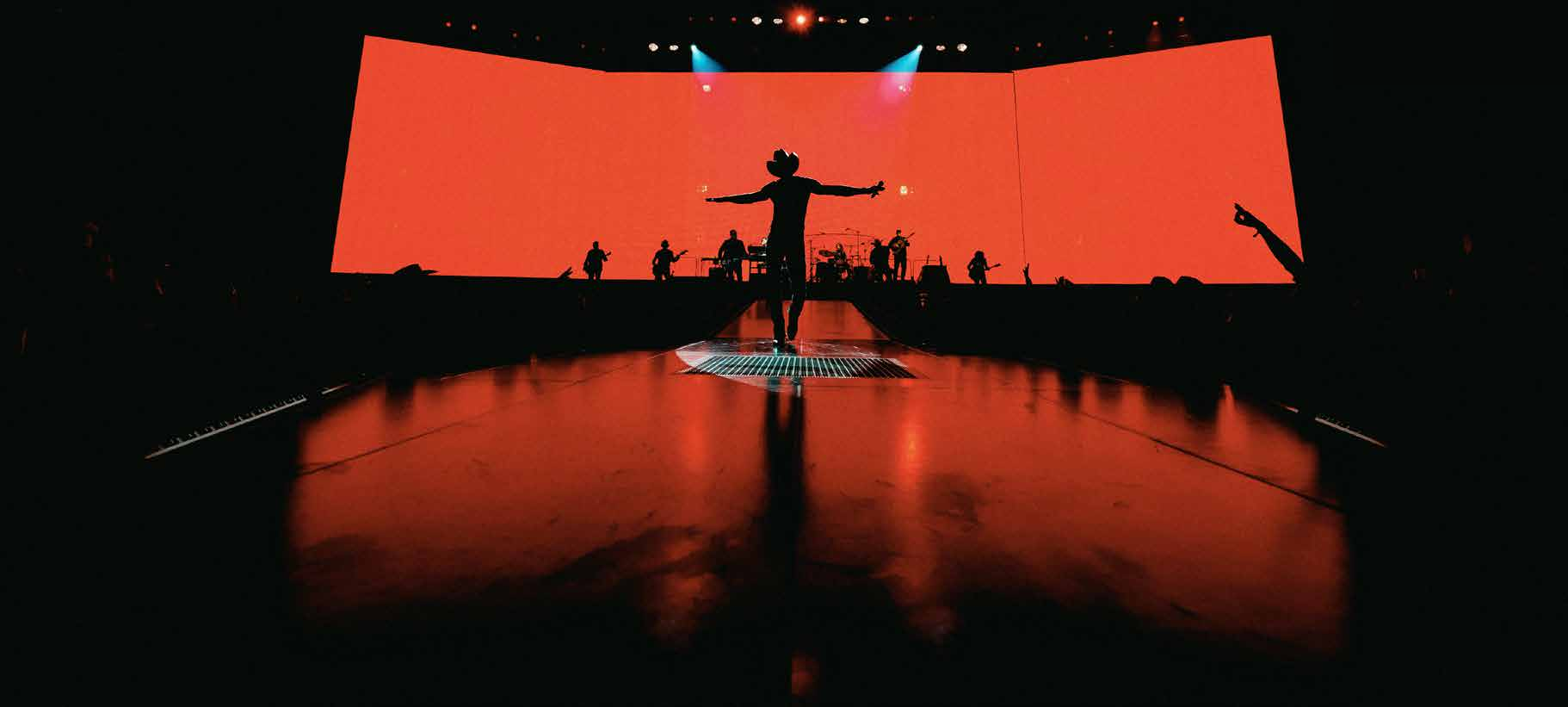

Tim McGraw - The Foundation

A 30-year, cross-generational American icon. Not a celebrity endorsement - a scalable platform asset with authentic Western credibility.

Music & Film Legacy

- 3 Grammy Awards, 14 ACMs, 11 CMAs

- Soul2Soul ($141M) - highest-grossing country tour

- The Blind Side ($309M), 1883 (Yellowstone)

- $80-100M+ music catalog (appreciating asset)

Sports Heritage

- Son of Tug McGraw (2x World Series champion)

- Former owner Nashville Kats (Arena Football)

- Active in Nashville WNBA expansion bid

- Multiple Super Bowl performances

Sports DNA: This is not a celebrity endorsement deal. Tim McGraw has generational sports credentials that no other country artist can match.

The Portfolio

The Assets We Bring

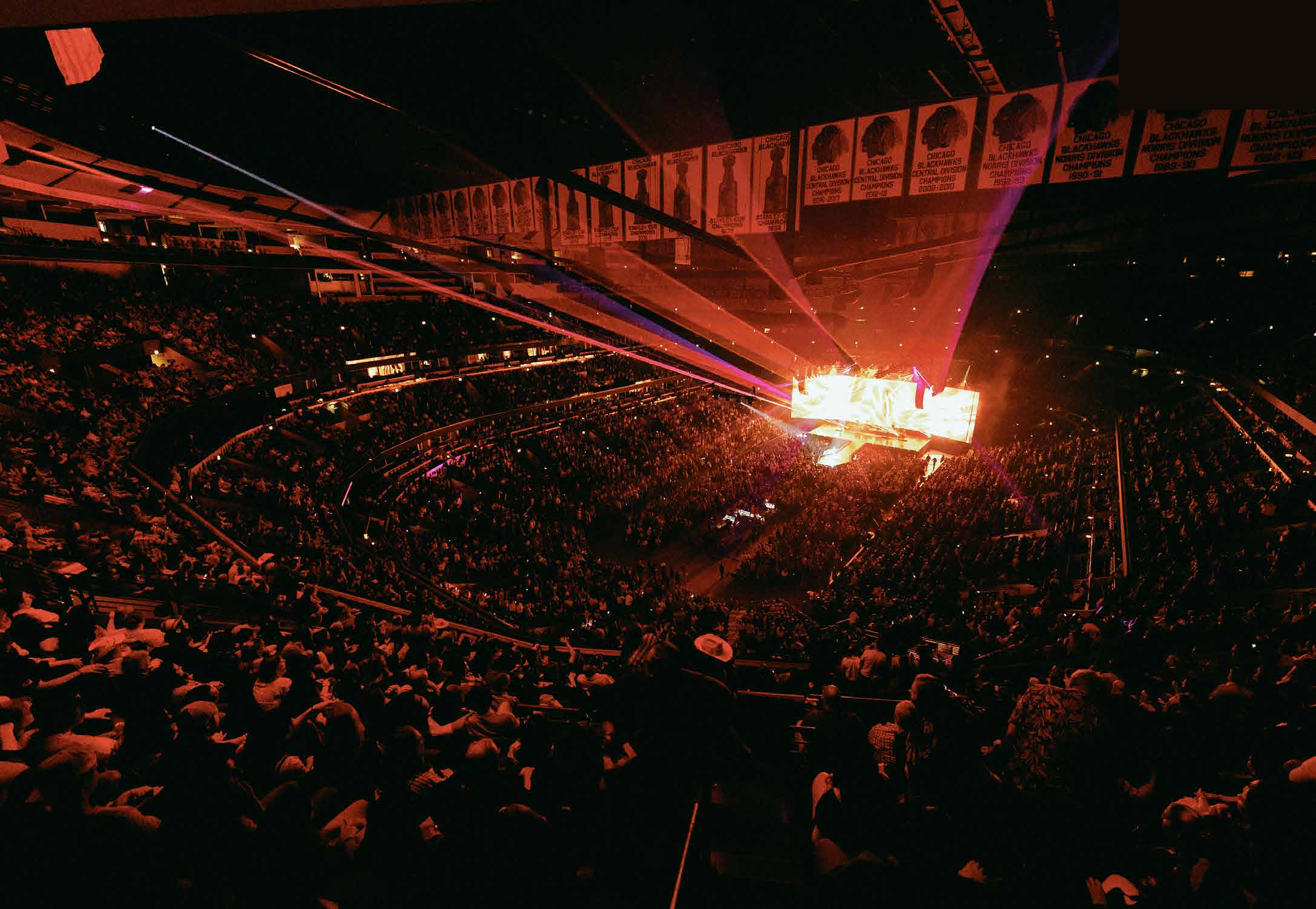

Music City Rodeo

$8.2M

Year 1 Revenue - SOLD OUT

- 31,750 tickets sold

- PRCA sanctioned

- Y7 target: $90M

Down Home Media

GREENLIT

Active Production Slate

- Feature Film - GREENLIT

- "Rowdy Friends" Broadway

- Skydance 15% owner

EMCo Management

Operations

30+ Years Experience

- Scott Siman-led team

- Industry relationships

- Proven track record

Music Catalog

$80M+

Hard Asset Floor

- $4M+ annual royalties

- 18-20x market multiple

- Independent exit path

Combined Platform Value: These assets are currently subscale and fragmented. Integration with Teton Ridge creates immediate enterprise value from synergies neither can achieve alone.

Value Creation

The Synergies: What Combining Creates

This is not a financial investment in isolated assets. It is the completion of an integrated platform where each piece amplifies the others.

Beyond Teton Ridge: Tim McGraw fits the full TWG thesis. Western entertainment (Teton Ridge). Sports venues (Draft House). Premium content (Down Home).

Beyond Teton Ridge

The Full Sports Ecosystem

Tim McGraw's sports heritage and Draft House concept unlock synergies across TWG's entire sports portfolio.

NFL

- Nashville Titans - $2.1B stadium 2027

- Super Bowl LXIII Nashville 2029 (finalist)

- Draft House at new stadium

College Football

- SEC Country - 45M fans

- 80%+ overlap with country demo

- Music City Bowl partnership

NASCAR

- 75M fans - country overlap

- Nashville Superspeedway

- Draft House at tracks

TWG Sports

- Dodgers - Draft House flagship

- Lakers - Crypto.com Arena

- Chelsea - International bridge

Draft House Flagship: Premium sports bar in Titans stadium development zone. 15,000 sq ft flagship with Titans as partner. $18-22M annual revenue potential.

Growth Strategy

MCR: National & International Expansion

National Roadmap

| Year | Markets | Revenue |

|---|---|---|

| 2025 | Nashville (SOLD OUT) | $8.2M |

| 2026 | Nashville Year 2 (ON SALE) | $12M |

| 2027 | Charlotte (CONFIRMED) | $28M |

| 2028 | Tampa, New Orleans | $52M |

| 2029+ | Boston + Research Markets | $90M+ |

International Expansion

UK (2028)

Chelsea connection. Country +23% YoY

Australia (2028)

Tamworth = "Nashville of Australia"

Canada (2029)

Calgary Stampede model

Mexico (2030)

Rodeo heritage. Long-term

Y7 MCR Total: $90M+ domestic revenue + international expansion potential. From one sold-out Nashville event to a national network.

The Dolly Parton Model

McGraw Brand: NIL & Lifestyle

Tim McGraw's Name, Image & Likeness - the Dolly Parton model for brand building. Dolly took 40 years. With TWG capital and infrastructure, Tim can do it in 10-15.

Current McGraw NIL

- Fragrances - Existing cologne line

- Music royalties - $4-6M/year

- Endorsements - Selective partnerships

$8-10M

Current Annual

Expansion Opportunities

- Apparel line - Wrangler, Boot Barn

- Spirits (Whiskey) - Distillery JV

- Boots/Footwear - Tecovas, Justin

- Home/Ranch - Williams-Sonoma

- Golf/Lifestyle - Course, equipment

Y7 NIL Platform

- McGraw Hotels - Boutique brand

- MCR Merchandise - Lifestyle apparel

- Draft House brand - F&B licensing

$58M+

Y7 NIL Revenue

The Dolly Parallel: Dollywood + DreamMore Resort + Stampede + Licensing = $650M+ net worth. Tim is 30 years into a 50-year timeline. With TWG, compress 20 years into 10.

The Opportunity

What Unlocks This Platform

$300M

Strategic Partnership Capital

This is not a fundraise. It is the capital required to unlock the platform - consolidating fragmented assets into a unified entity that completes Teton Ridge's Western entertainment thesis.

Buy out minority investors

Scale MCR, content, events

Western lifestyle verticals

Structure: 50% ownership of consolidated platform. Full alignment with long-term hold thesis. No pressure for near-term liquidity events.

Capital Deployment

Use of Funds

| Category | Amount | % |

|---|---|---|

| Entity Consolidation | $100M | 33% |

| Down Home buyout | $45M | 15% |

| MCR investor buyout | $35M | 12% |

| Other consolidation | $20M | 6% |

| Growth Capital | $150M | 50% |

| Live events expansion | $75M | 25% |

| Content development | $50M | 17% |

| Working capital | $25M | 8% |

| Strategic M&A | $50M | 17% |

| Total | $300M | 100% |

Why Consolidation First

Today's fragmented structure makes the assets uninvestable for institutional capital. Consolidation creates a clean, unified entity with professional governance that can scale.

Growth Capital Focus

- MCR expansion: Nashville flagship + new markets

- Content: Original series with Teton Ridge distribution

- Sponsorship: Premium Western lifestyle brands

Financial Model

7-Year Platform Projections

| Metric | Year 1 | Year 5 | Year 7 |

|---|---|---|---|

| Revenue (Base) | $28M | $178M | $255M |

| EBITDA (Base) | $(5M) | $27M | $46M |

| EBITDA Margin | - | 15% | 18% |

| MCR Markets | 1 | 3 | 4+ |

Scenario Analysis

$180M Rev

$176M Value

0.6x MOIC

$255M Rev

$460M Value

1.5x MOIC

$320M Rev

$768M Value

2.6x MOIC

Revenue Mix at Y7 ($255M)

| MCR Events | $90M | 35% |

| McGraw NIL | $58M | 23% |

| Down Home Content | $50M | 20% |

| Draft House | $35M | 14% |

| EMCo Management | $22M | 9% |

Platform Value at Y7

$460M+

Base Case (10x EBITDA)

Hard Asset Protection: $80M+ music catalog provides downside floor regardless of operations.

Operating Structure

The Management Model

The same model as your Dodgers and Lakers holdings - professional management runs operations while ownership provides capital and strategic guidance.

Executive Leadership Team

- Tim McGraw - Founder & Chairman

- Scott Siman - CEO (25+ years, Tim's manager)

- Al Hagaman - CFO (Financial leadership)

- Kelly Clague - President (Platform operations)

- Brian Kaplan - CCO (MCR & Down Home co-founder)

Down Home Board: David Ellison (CEO, Paramount/Skydance) is a 15% owner. He modeled Skydance after Thomas Tull's Legendary Pictures. David is the introduction to TWG.

TWG / Teton Ridge Role

- Strategic capital deployment

- Platform integration with Teton Ridge

- Board oversight & governance

- M&A and partnership guidance

- Long-term value creation focus

The Dodgers Model:

Professional management operates. Ownership provides capital and vision.

Everyone stays in their lane. Value compounds.

Partnership Terms

Governance & Structure

Board Composition

- 5-person Board - Balanced governance

- 2 TWG seats - Strategic oversight

- 2 McGraw/EMCo seats - Operating expertise

- 1 Independent seat - Tie-breaker, industry expert

Milestone-Based Funding

- Tranche 1: $75M - Close + entity consolidation

- Tranche 2: $125M - MCR Y2 success + Charlotte launch

- Tranche 3: $100M - Content traction + scale

Capital deployed against proven milestones

Reserved Matters (Board Approval)

- M&A transactions >$10M

- Debt facilities >$25M

- Key executive hires/terminations

- Tim McGraw participation agreements

- Annual budget approval

- New market expansion commitments

Reporting & Transparency

- Quarterly: Financials, KPIs, board meeting

- Annual: Audited financials, strategic plan

- Event-driven: Material developments within 48 hours

Risk Management

Key Person & Risk Mitigations

Tim McGraw Protections

- Key Person Insurance: $50M coverage

- 7-Year Commitment: 100 days/year minimum

- Exclusivity: No competing ventures

- Health Notifications: Board notice 72 hours

- Succession Plan: Developed by Y5

- Brand Continuity: Platform operates beyond individual

Milestone-Gated Capital

- Phase 1 (Y1-2): $100M | Gate: $50M+ revenue

- Phase 2 (Y3-4): $120M | Gate: $150M+ revenue

- Phase 3 (Y5-7): $80M | Gate: Exit ready

| Risk | Impact | Mitigation |

|---|---|---|

| Tim health/availability | High | Insurance + minimums |

| Revenue miss | High | Milestone tranches |

| Competitive entry | Medium | First-mover + PRCA |

| Content delays | Medium | Diversified slate |

| Expansion challenges | Medium | Pilot markets first |

Downside Protection: $80M+ music catalog provides hard asset floor. Even in stress scenarios, catalog value protects invested capital.

Why This Partnership

Why TWG

We sought out TWG specifically because of who you are - not just what you can fund. This opportunity requires a specific type of partner.

Long-Term Hold

You don't flip assets. Dodgers (12+ years). Lakers. This is a generational platform, not a quick trade.

Undervalued Category

Western entertainment is where sports was 20 years ago. You see value before the market catches up.

Community Impact

Sports and entertainment create community value beyond returns. This is a Nashville institution in the making.

The Dodgers Parallel:

$2.1B acquisition (2012) → $7.7B valuation (2024)

Patient capital. Premium asset. Community institution. 267% return - without selling.

The Opportunity

The Complete Platform

$300M

Milestone-Based Partnership

Close + Consolidation

MCR Expansion + Charlotte

Content + Scale

5 Core Pillars: McGraw NIL | Down Home Content | MCR Events | Draft House | EMCo

The Dolly Parton model - built in 7 years with TWG capital and infrastructure.

Tim McGraw + TWG Global

The Complete Western Entertainment Platform

Contact: Scott Siman | EMCo Management | Nashville, Tennessee

January 2026 | Confidential | Not For Distribution